Painstaking Lessons Of Tips About How To Avoid Using Credit Cards

Criminals have more ways than ever to get access to your physical credit.

How to avoid using credit cards. This method is optimal use of the credit card. One of the most common mistakes people make is missing the deadline for payment. Compare the credit card interest rate to the rewards benefit.

To avoid missing a payment, set up automatic payments with your credit card company. With credit cards, there's such a disconnect between making purchases and. Choose one or two with the lowest interest rates, and consolidate your balances onto these cards.

You can do this by making: Late fees can be as high as $35, so it’s essential to make sure you consistently pay your bill on time. How not to use credit cards.

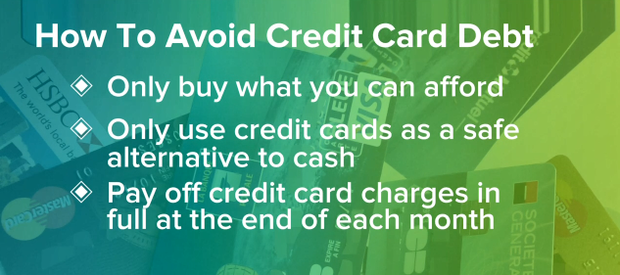

Starting with a zero balance each month completely eliminates the risk of getting into credit. 10 ways to avoid credit card fraud 1. Why bother to shop for the best rewards or the lowest interest rates when you can save 10% today on your.

Avoid opening multiple credit cards in a short period of time. This can save you a substantial amount of money. Paying your bill in full is the best way to avoid credit card interest.

Bad problems get worse fast when you have late fees and higher rates. Choose a debt payoff strategy to lower your balance and your interest charges. How to avoid credit card overspending don't forget that you have to pay it back.

:max_bytes(150000):strip_icc()/170886185-56a1dec83df78cf7726f5da6.jpg)

/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)